GameStop: What Happened, and What It Means

It lets people trade stocks and even more exotic investments, like options, for little or no charge. Over the following week, the stock plummeted, trading at a little over $50 per share just a week after reaching that all-time stratospheric high. A few days later, Tyler Winklevoss tweeted a link to reports about the film and said that when the movie comes out he and his brother will be renting AMC theaters (another popular stock within r/wallstreetbets) for “premiere parties.” Cohen is the founder and former chief executive of the e-commerce platform Chewy and one of the largest shareholders in GameStop through the private firm he operates, RC Ventures. Still, the company reported an operating loss of $63 million in the third quarter.

“So it started out as kind of a little bit of a value investing story,” he added. “But then this sort of technical phenomenon, which is called a short squeeze, that was really sort the dynamite that was thrown on the kindling.” Gill also posted screenshots of his GameStop portfolio on r/wallstreetbets as far back as 2019. Gill and other members of the forum also cited the bullish GameStop stance of Michael Burry, the legendary trader who was portrayed by Christian Bale in the 2015 film “The Big Short,” as fuel for their investment choices. Attal was the former chief marketing officer at Chewy, and oversaw its rapid expansion from three people to more than 10,000 employees. Grube was the formerly the chief financial officer at Chewy, among other executive roles in the e-commerce space.

Last month, a Deutsche Bank survey of 430 retail investors found they planned to put 37%, on average, of any stimulus cheques directly into equities. But on Wednesday, the share price was approaching its January high. And that spike was widely thought to have been a one-off – hedge funds would never again allow themselves to be blindsided.

GameStop Takes With Katie Baker. Plus: Super Bowl Hype!

In February, the prevailing attitude on Wall Street was the share price was slowly finding its natural position. GameStop’s shares slumped by 40% in 25 minutes on Wednesday, after a few days of frenetic growth. And the enthusiasm was still spreading to other well-known consumer brands. Bed Bath & Beyond shares were up by 176 percent Wednesday from the start of the year, while Tootsie Roll Industries, the candymaker known for iconic 20th century commercials, was up by 41 percent since Jan. 1.

- GameStop shares plunged nearly 20% the next day, closing on Dec. 9 at $13.66 a share.

- In 2008, when Volkswagen was in the middle of a trader tug-of-war, it briefly became the stock market’s most valued company, but its price settled down eventually.

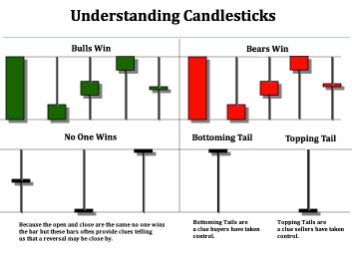

- This is a massively simplified explanation of something called shorting, or short selling – words you might’ve seen cropping up in your feeds in the last few days.

- They borrow shares in the company and sell them, with a promise to buy them back at a later date.

- On the 29th, data from fintech company S3 Partners showed that short-selling hedge funds had suffered a year-to-date market-to-market loss in GameStop of $19.75 billion.

- You’ve probably stared blankly at your WhatsApp chat as the words “GameStop”, “Reddit” and “stock market” get thrown around the way “pub” and “meet at 8” used to.

CNBC data show that the volume of shares traded — a closely watched indicator of activity around the stock — spiked on Friday. Increased volume can indicate a short squeeze, meaning people who had bet against the stock either chose or were forced to give up and take losses. This is where things get a little complicated and a bit more unclear. Shares in GameStop ticked up on Jan. 11 after it named three people to its board of directors as part of a deal with shareholders who had been agitating for change. That caused some short sellers to abandon their positions, helping to drive the stock up more in the following days.

news Alerts

From how Animal Crossing taught gamers how to pick stocks to the beach bum who made millions betting on the short squeeze happening to what a short squeeze is, The Ringer has the GameStop stock saga covered from all angles. The U.S. Securities and Exchange Commission on Jan. 29 issued a statement saying it is “closely monitoring and evaluating the extreme price volatility of certain stocks’ trading prices over the past several days.” The Tesla chief executive has some 44 million Twitter followers and was already a popular figure among users of the Reddit forum — especially as Tesla stock soared in recent years despite questions over the company’s actual valuation. “That was part of the driver,” Moallemi said of GameStop’s stock’s meteoric rise. “The second part of the driver was the observation that there were a number of hedge funds who basically had a bet that GameStop would go to zero.” Gill publicly touted GameStop stock long before it caught the eyes of Wall Street and the world.

The Sydney Morning Herald reported the diversification into merchandise through the establishment of the Zing Pop Culture brand in 2014 had been vital in keeping the company profitable. The newspaper reported the greater focus on merchandise allowed the company to tap into the lucrative, higher-margin merchandise market of t-shirts, figurines and bobbleheads. The newspaper noted former staff agreed that the Australian divisions’ merchandise pivot has been key to the divisions survival in Australia’s https://www.day-trading.info/ tough retail landscape. However, they also pointed to the pre-owned games segment as a major part of its success.[110][111][112] GameStop’s Australian division has been the only profitable segment of the global GameStop business for the 2020, 2021 and 2022 fiscal years. The company reported profits of US$9.4 million, US$52.2 million and US$30.6 million for each fiscal year respectively. Believing GameStop overpriced, hedge funds had “shorted” the company, betting the share price would fall.

They borrow shares in the company and sell them, with a promise to buy them back at a later date. People who buy and sell stocks often bet on which companies won’t do well in the future. And that, in turn, is having a real-world effect on the share price right now. And that pretty meagre announcement generated a load of buzz on WallStreetBets – which in turn, foot pumped the share price.

Many people on the WallStreetBets Reddit forum realised if together they drove up the price, the hedge funds would have to try to buy back shares, to cut their losses, raising the price still further. There is some belief that WSB signals the arrival of a powerful new force as large numbers of retail investors find https://www.investorynews.com/ influence by acting in concert or following one another into a big trade. That may serve as a check or balance on other large forces, such as hedge funds, which are used to throwing their weight around without ordinary investors affecting a price. “I believed the company was dramatically undervalued by the market.

MORE: Silver surges, AMC ticks up and GameStop falls as retail investors shake up markets

“100% of my portfolio on GME because of you idiots,” a person posted Jan. 10. On Wednesday, the people who run WSB temporarily made the community private and said they were “experiencing technical difficulties based on unprecedented scale as a result of the newfound interest in WSB.” Mike Novogratz, an investor and former hedge fund manager, said the internet activity is the result of frustration that everyday investors are often locked out of lucrative opportunities, such as initial public stock offerings. But it has led to serious questions being asked about the way the financial system works. What are the implications of colluding in online forums to influence the prices of assets? Unfortunately, it does not seem likely that we will receive pertinent answers to such questions any time soon.

Often, a short squeeze ends in a price’s falling back to where it was before the drama started. In 2008, when Volkswagen was in the middle of a trader tug-of-war, it briefly became the stock market’s most valued company, but its price settled down eventually. The market researcher told the Exchanges at Goldman Sachs podcast that he expects more short squeezes in the future, particularly in illiquid assets and less covered corners of the market. “It seems to me that we’re in a market where prices are moving a lot. It’s probably not that horrible if a couple [of] stocks every now and then go crazy. But I’m more concerned about the whole system being fragile,” he said.

Interview with Mr. Dowlat Parbhu, Chief Executive Officer,…

“The current pandemic has created a unique situation where many people who have gotten into day-trading really have no idea exactly what they’re doing,” he told CNBC. But the bigger and longer-lasting impact may be on how the market itself operates. Never before has a group of amateur investors taken on a hedge fund like this and won. The battle over GameStop has taken on something of a David vs. Goliath feel, with some people outside of finance painting it as a reckoning for parts of Wall Street. The internet has been used to prognosticate about stocks for decades, but there’s never been anything quite like the Reddit community called r/wallstreetbets, also known as WSB.

If you believe this theory, you should buy GameStop shares before the cash is sent out – and then ride the wave up. With Joe Biden signing off a $1.9tn (£1.4tn) economic relief bill on Thursday, a load of new cheques are likely to arrive on people’s doorsteps in the coming weeks. “Reddit is like the definition of confirmation bias,” Matt Kimbro, from PR company NowADays Media, told me. And far from being a failing, bricks-and-mortar gaming company, it is well placed to move into the digital space, where even a small part of the market would make it hugely valuable. Galvin said he believed federal regulators would take some action. White House press secretary Jen Psaki said Wednesday that the Biden administration’s economic team was “monitoring the situation” around trading in GameStop.

There are Love Island forums, football forums, history forums – you name it. You’ve probably stared blankly at your WhatsApp chat as the words “GameStop”, “Reddit” and “stock market” get thrown around the way “pub” and “meet at 8” used to. J Acquired Geeknet, https://www.forex-world.net/ Inc. (“ThinkGeek”), a United States-based online and wholesale Pop Culture retailer. G Acquired Simply Mac, Inc. (“Simply Mac”), a United States-based Apple specialty store retailer. Wall Street sometimes refers to these kinds of investors as “dumb money”.

On the 29th, data from fintech company S3 Partners showed that short-selling hedge funds had suffered a year-to-date market-to-market loss in GameStop of $19.75 billion. In the week following GameStop’s reaching its peak share price, around $36 billion of value was wiped off of its value, as well as that of four other “meme” stocks that were being traded in a similar fashion. And by March 9, those who had bet against GameStop were facing a total of $11 billion in year-to-date losses. As such, the overriding narrative that has since emerged has not been entirely dissimilar to “David Beats Goliath”. A forum full of internet dwellers took on the behemoths of Wall Street—and won. The company’s performance declined during the mid-to-late 2010s due to the shift of video game sales to online shopping and failed investments by GameStop in smartphone retail.

Most of the traders who have been piling into the stock are likely chasing easy profits, and probably do not care whether GameStop’s strained business could make a miraculous turnaround. The frenzy for the troubled retailer’s stock has been a head-scratcher for the analysts who try to determine a company’s value. If your bet was wrong and the price actually rises instead of falling, you’d lose money.